Los Angeles Office Research Summary & Leasing Activity

Key Insights from Q3 2024

Discover the future of TV with OLED technology

The Los Angeles office market in Q3 2024 continued to grapple with the challenges of high vacancy rates, shifting tenant preferences, and the rise of hybrid work, though there were pockets of activity, especially with large, high-profile leases. The outlook remains cautious as companies continue to assess their space requirements, but certain submarkets are likely to see continued activity from industries with ongoing demand for premium office environments.

Interactive Map: Explore Q3’2024 Office Leasing Activity

Explore the key office leasing transactions of Q3 2024, featuring deals over 25,000 SF, using our ArcGIS Interactive Map. Dive into the latest leasing trends, notable tenant movements, and property data across Greater Los Angeles, all visualized in an engaging, easy-to-navigate format.

Source: Colliers Research; CBRE Research; JLL Research

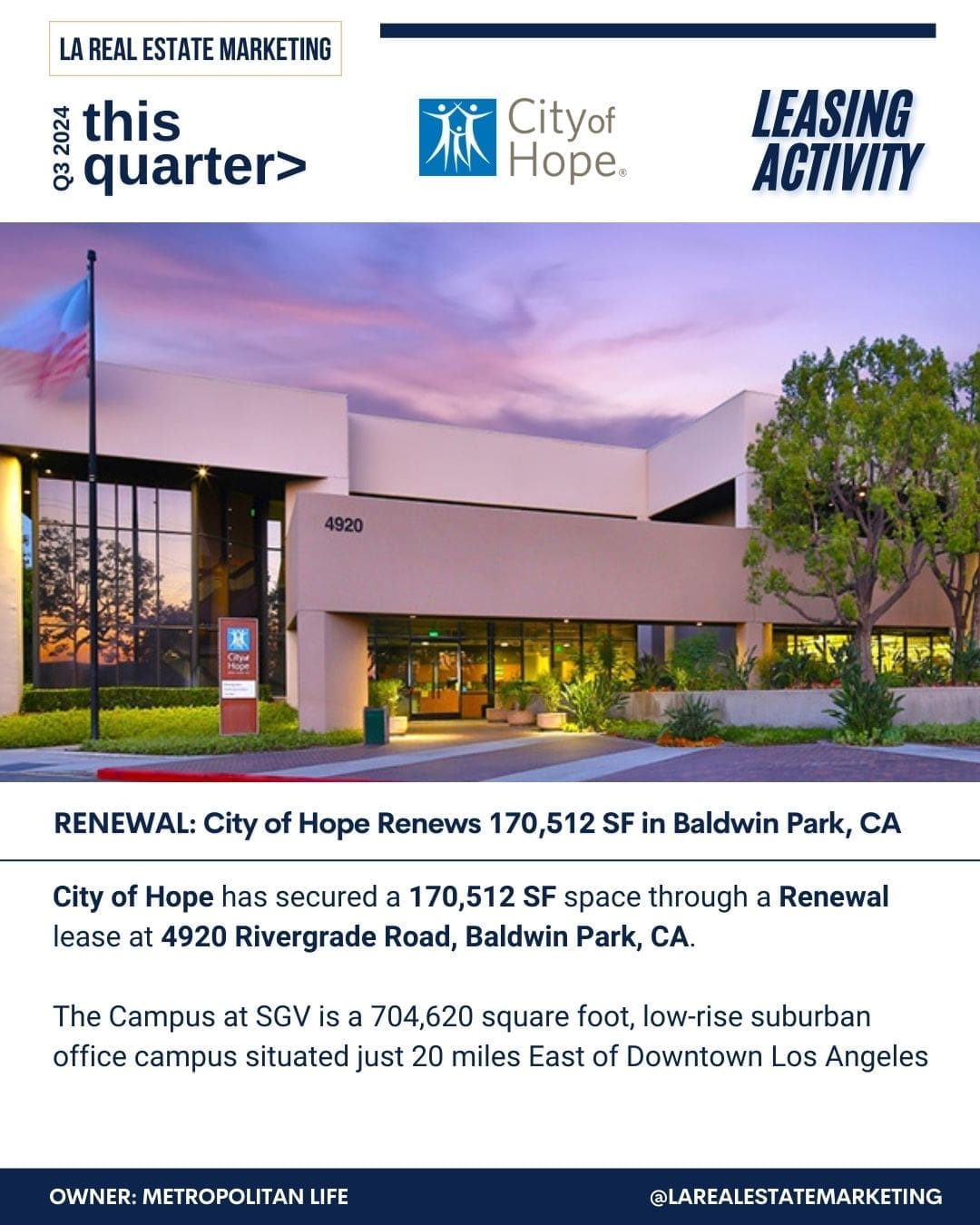

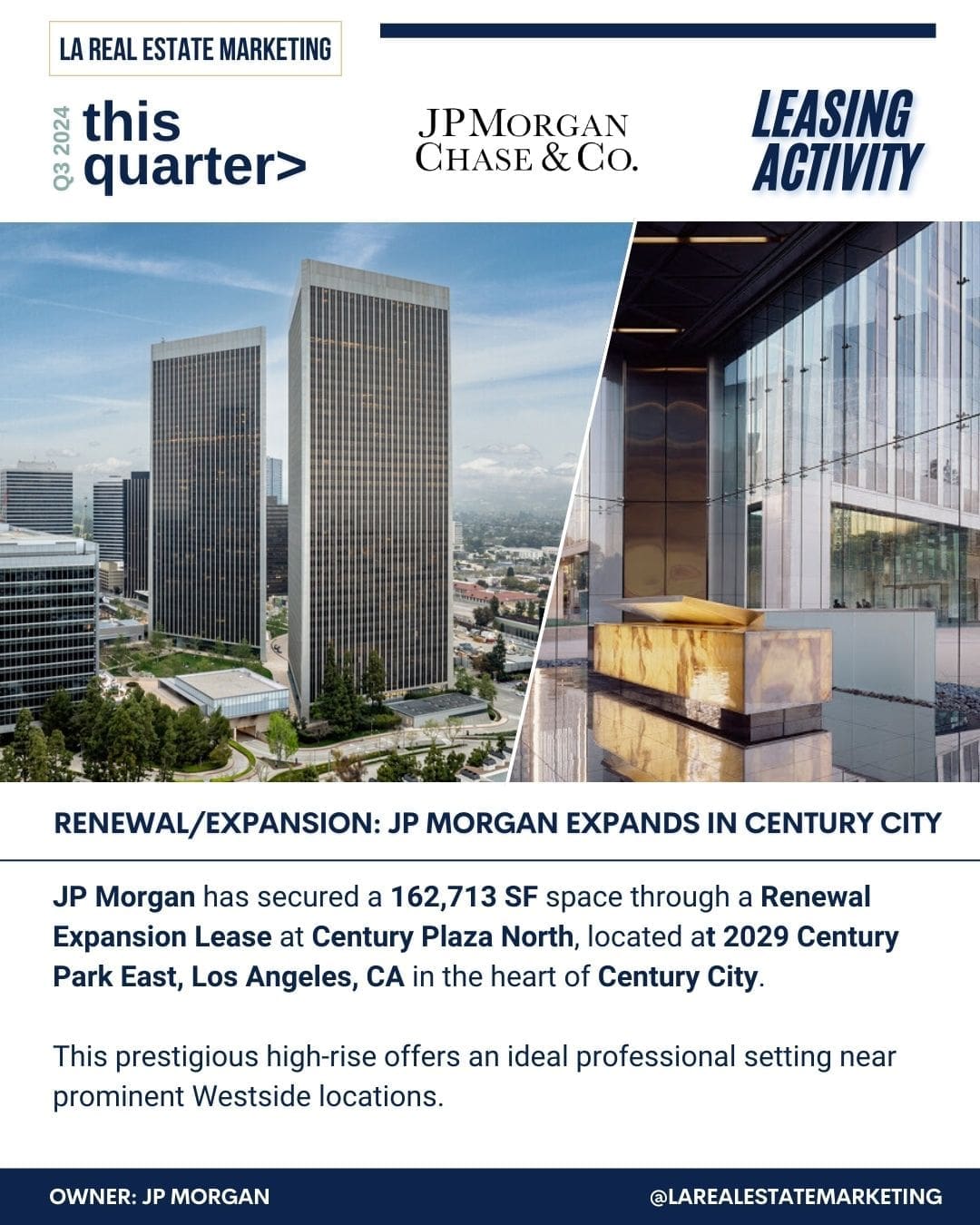

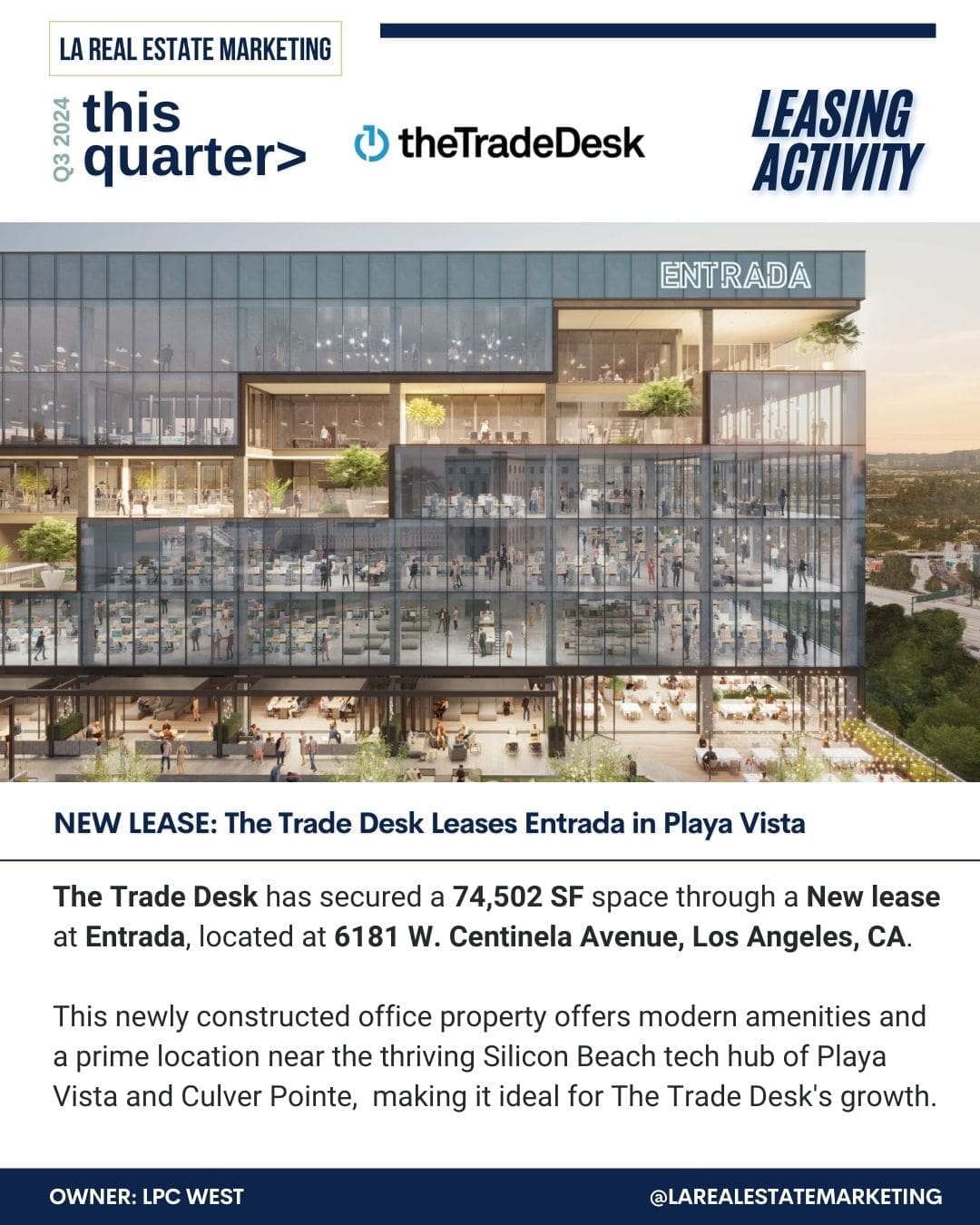

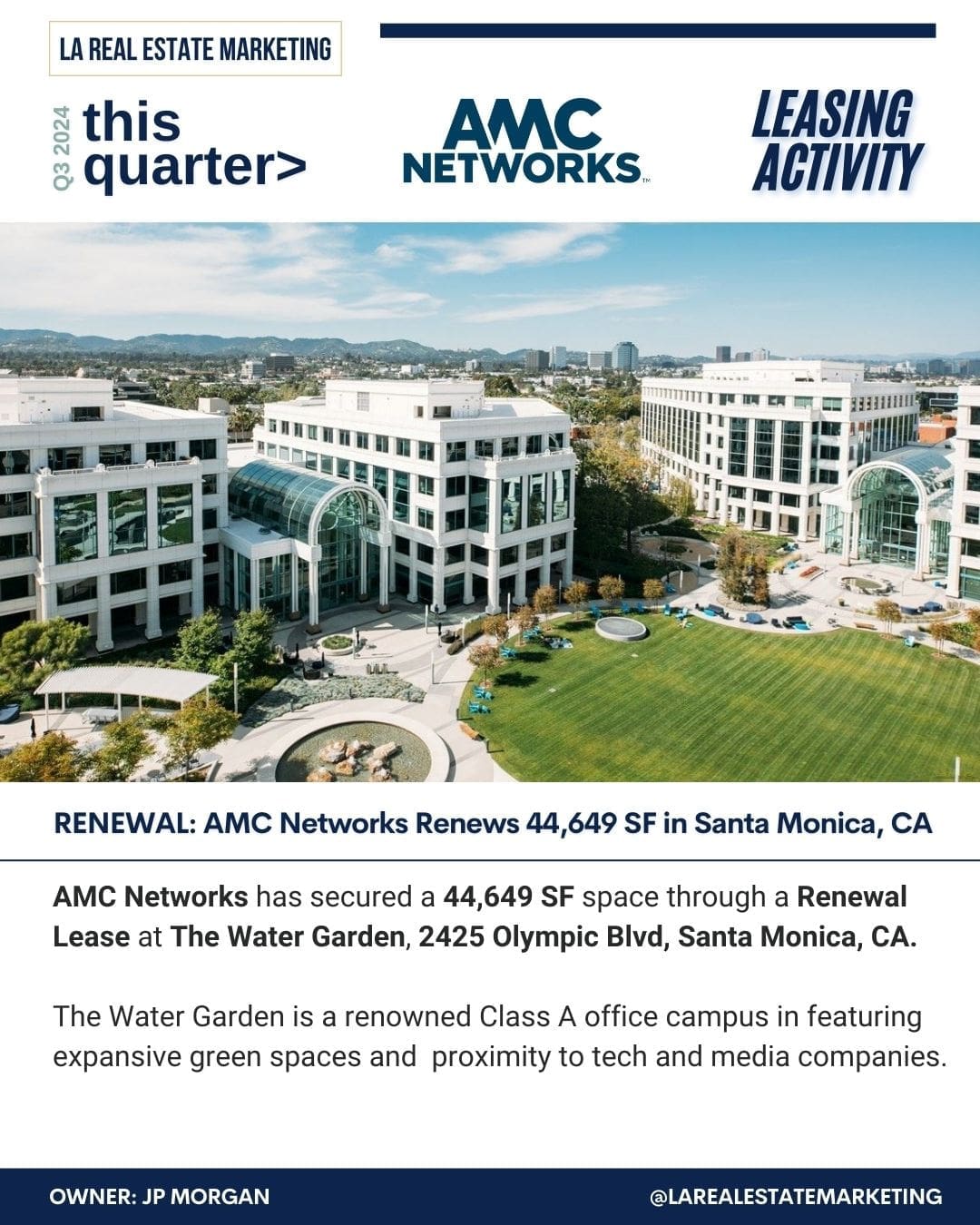

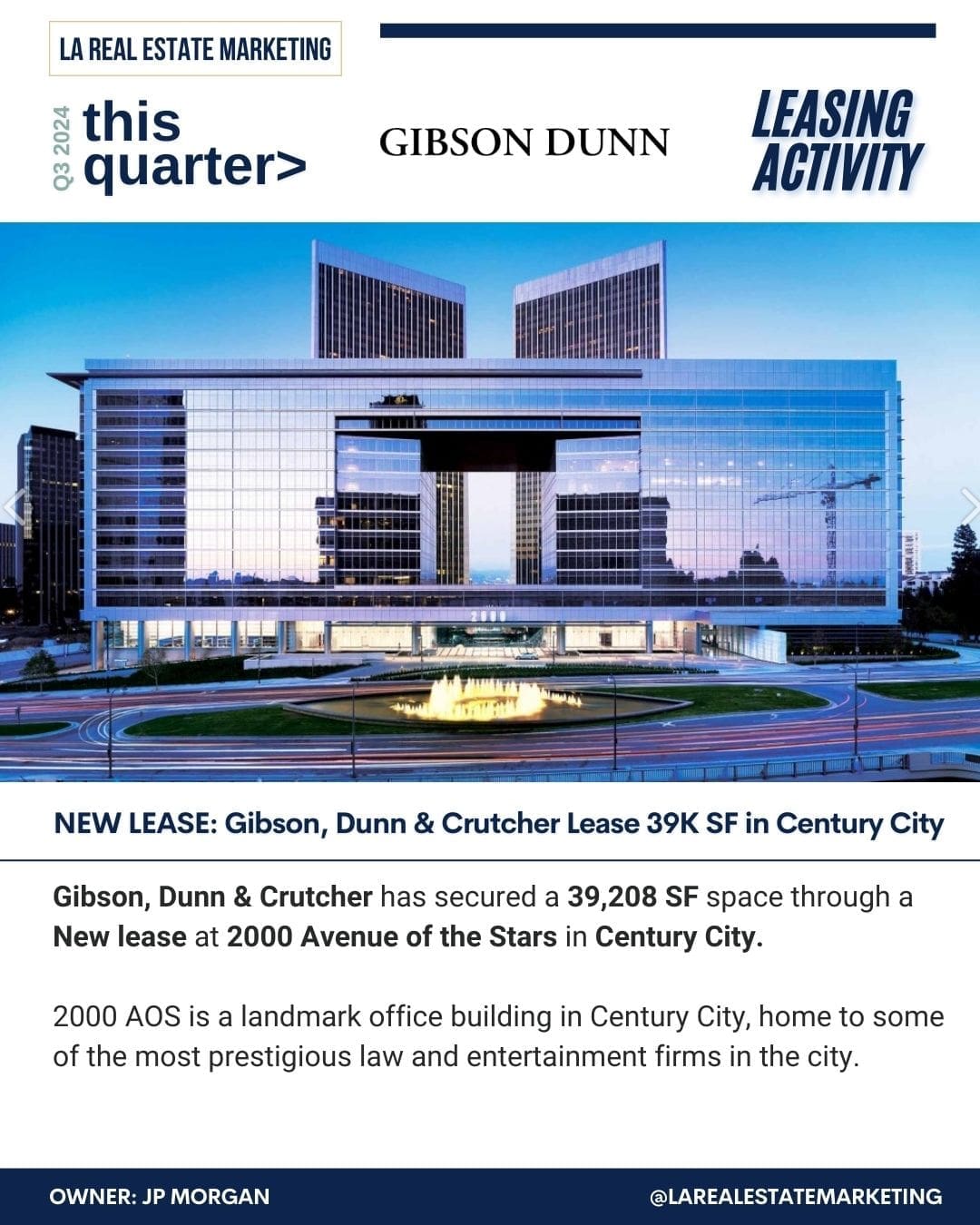

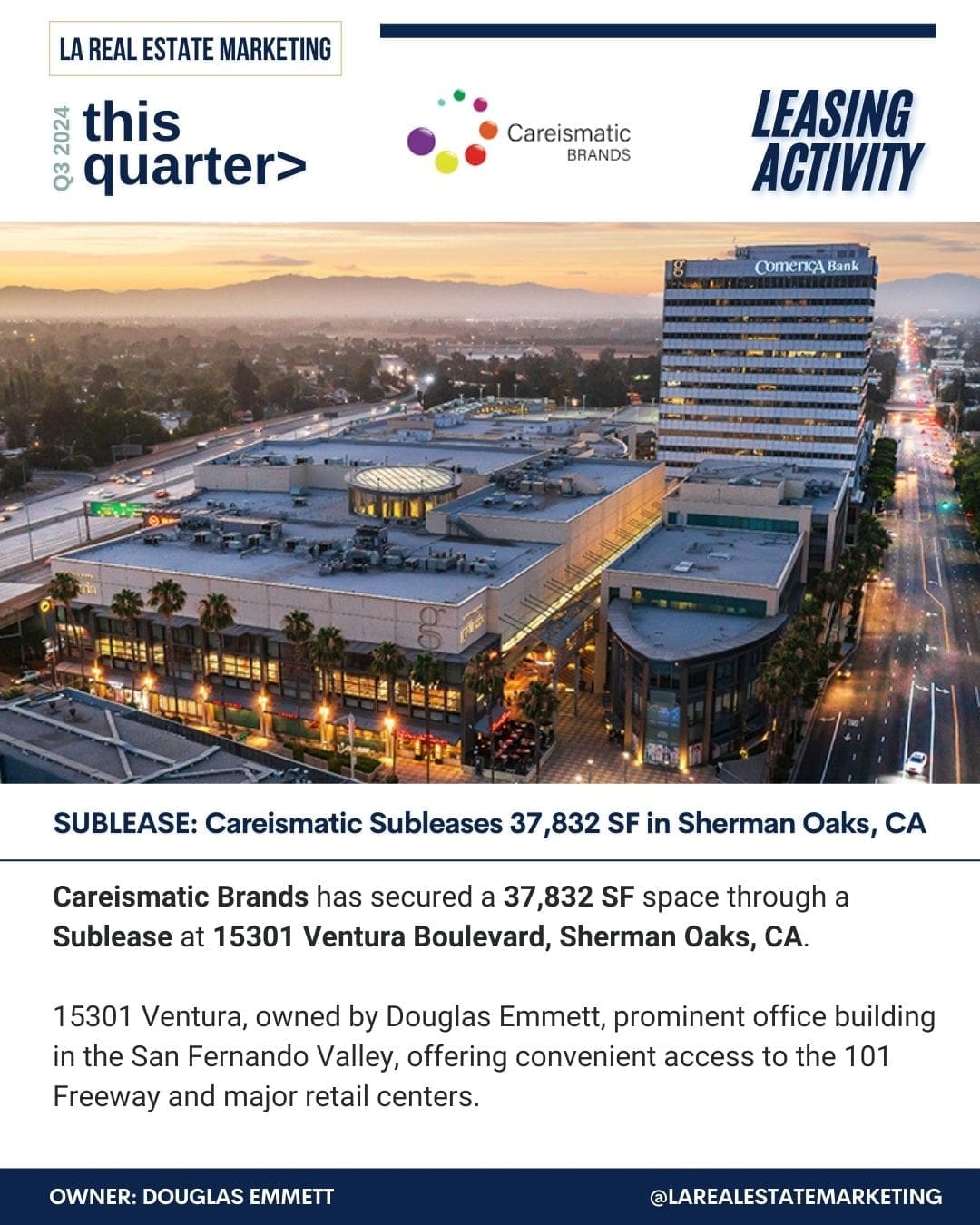

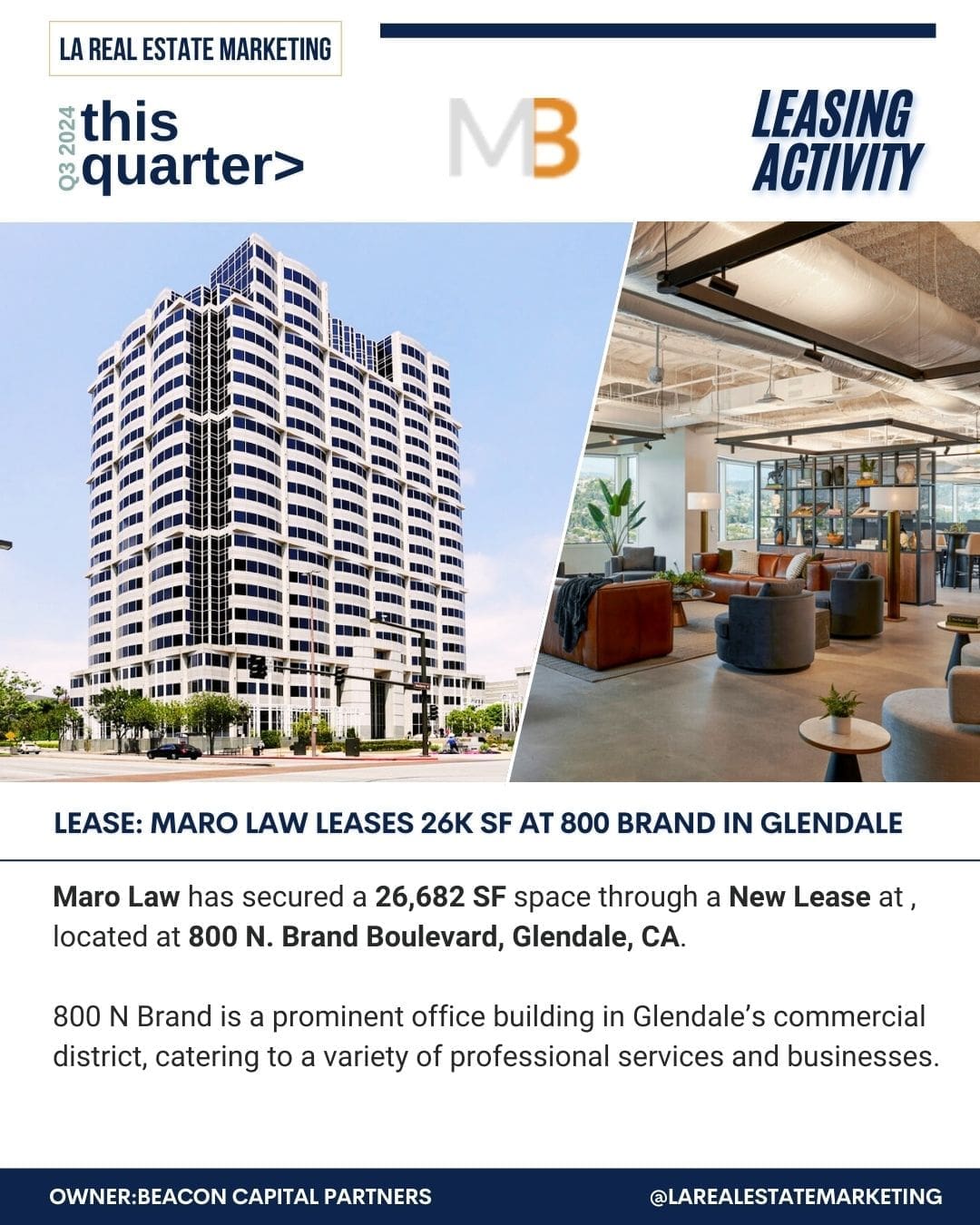

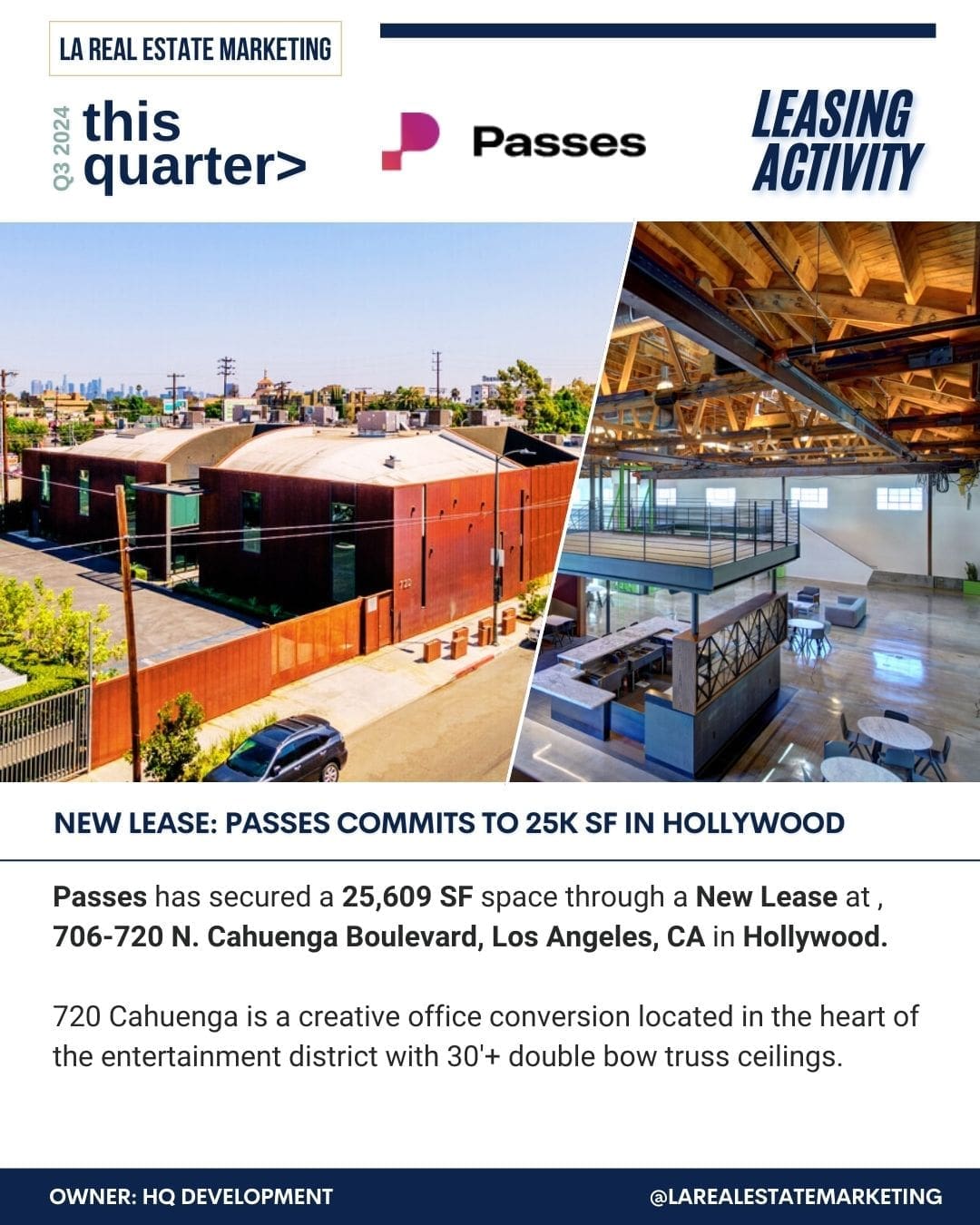

25,000+ Sq. Ft. Office Leasing Activity Summaries

Explore the most significant office leasing transactions across Los Angeles, each exceeding 25,000 SF, through this dynamic image carousel. Featuring 22 key deals from Q3 2024, the summaries highlight tenant movements, lease details, and key properties shaping the Greater LA office market. Use this visual breakdown to stay informed on the latest in large-scale leasing activity.

Collection of LA’s Office Market Research Reports

Your One-Stop Hub for Quarter-End Reports

Bringing you the most accurate and up-to-date data on the Los Angeles office market, we’ve gathered Q3’24 reports from leading industry experts to give you a comprehensive view. Whether you’re an occupier, investor, or landlord, these resources provide key insights to help you make informed decisions.